What is halal investing?

Halal investing is investing in companies that are in line with Islamic principles of investing. A lot of conventional investment products aren't compliant. For example, profiting off debt is prohibited, so bonds and GICs are off the table for observant muslims. Additionally, halal investing prohibits businesses that profit off certain activities, including alcohol, tobacco, gambling, pork, and weapons, among others.

What's included in the Halal Investing portfolio?

The Halal Investing portfolio includes 50 stocks selected to track the broad market as closely as possible to maximize our clients’ diversification, while complying with Islamic law. See the entire list of stocks here.

What risk profile is the Halal Investing portfolio?

The Halal Investing portfolio is an all-equity investment portfolio, so it's a higher risk portfolio. As it doesn't include fixed income to mitigate risk, investors should keep more of their assets in cash than investors who are in more conservative portfolios.

Why isn't there a Balanced or Conservative option for the Halal Investing portfolio?

Wealthsimple's other portfolios use fixed income (bonds) to lower the overall risk of a portfolio for balanced and conservative investors. Islamic investing principles exclude fixed income, so the Halal Investing portfolio is an all equity portfolio. Equity is more volatile than fixed income, so it is a higher risk Growth portfolio.

We recommend keeping more of your assets in cash if you're investing in the Halal Investing portfolio, and speak with one of our portfolio managers if you have any questions.

What are the fees for Wealthsimple's Halal Investing portfolio?

We charge the same fees as for our halal portfolio as we do for our regular and socially responsible portfolios: nothing on the first $5,000 for a year, 0.5% up to $100,000, and 0.4% over $100,000. Plus, you get an additional $10,000 managed free for every friend you refer to Wealthsimple!

Why am I being advised to hold cash?

Based upon your ability to take risk and your investment objectives we will advise on a certain risk profile that may include cash. In these cases, cash replaces fixed income we would otherwise employ for other mandates.

Does the Halal Investing portfolio use ETFs?

No, it uses individual stocks rather than ETFs. But the process we use to construct our Halal Investing portfolio is very similar to an ETF, which tracks a market index as a whole, rather than trying to pick stocks.

Does the Halal Investing portfolio use bonds?

No. Bonds pay interest, which is not allowed under Islamic law. The Halal Investing portfolio is an all equity (aka stocks) portfolio.

Is the Halal Investing portfolio considered active or passive investing?

The Halal Investing portfolio uses a passive investing strategy, like Wealthsimple's other portfolios. It represents 50 stocks that were selected to track the broad market as closely as possible.

What research do you do to ensure that the companies in the portfolio follow Shariah law?

We created the portfolio in partnership with MSCI, one of the world's largest index providers, and we used a methodology approved by MSCI’s Shariah advisors’ committee of scholars.

Will my portfolio be rebalanced in a similar way to other Wealthsimple portfolios?

Yes, we rebalance your portfolio on a regular basis (like our other portfolios) in response to price changes (the markets), deposits or withdrawals, or changes in your risk score. You don't have to do anything!

We may also rebalance the Halal portfolio should the MSCI index get rebalanced. MSCI updates their model quarterly, in which case you may see a change in one or a few of the stocks in your portfolio.

Can anyone invest in the Halal Investing portfolio?

Of course! Anyone who is a suitable investor can invest in this portfolio.

Do you offer Dividend Purification?

Yes, we do. As of October 2018, the purification value shows on clients' monthly statements as well as Annual Statements. This amount resets at the end of the year (after December 2018), and starts calculating again in January. It is a cumulative amount.

Each security in the Halal portfolio has a dividend adjustment factor. For example, for some securities (such as PFE:US, PPL:CA, CVX:US, etc.) you are entitled to the full dividend. Therefore, the dividend adjustment factor is 1.00. For other securities, such as NTR:CA, the dividend adjustment factor is 0.99910, meaning you are not entitled to the full dividend. We calculate which portion of a dividend should be donated. In other words, when the adjustment factor is less than 1.00, part of the dividend stems from a corporate activity which does not comply with Shariah law. It is up to each client to decide how and if they donate this amount based on what they see in their statement.

Can the Halal Investing portfolio be customized?

Wealthsimple has one version of Halal Investing portfolio and it can't be customized. We've built a fully diversified portfolio of stocks that complies with Shariah law constructed by the expert team at MSCI.

Can I expect the same performance as in other Wealthsimple portfolios?

The Halal Investing portfolio is 100% invested in equities. This means the risk profile and portfolio construction is similar to the standard Growth portfolio, but without the bond holdings.

As it's a new portfolio we don't have performance data available yet. The performance should be similar over the long run to a Growth portfolio, but it as an all-equity portfolio, investors should expect to see more fluctuation than in other portfolios.

Latest Articles

- 70 photo tourism about Bangladesh

- Technological advencement, AI & Robot technology

- Helium 3 - The moons energy solution for earth

- Marriage in Tatarstan, Russia

- Flock animal walk in acircle

- Delaration of war hit up

- Sanction and War

- Fish is falling from the sky

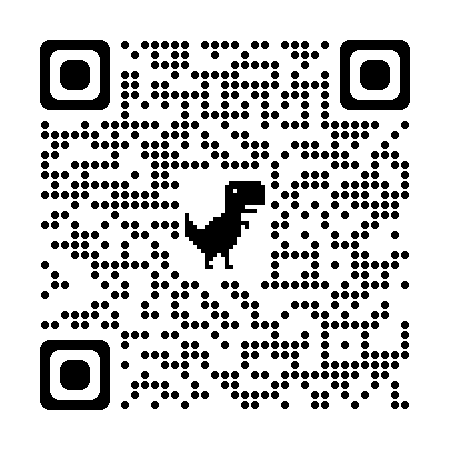

- App just lunched

- Who created God

- Truth humanity needs to know about west

- Quran recitation that will make you cry

- Quran recitation could soften your heart

- Just published Social media site

- Product branding is our motto

- Shop416.com in Shopify : success just around the corner

- Shop416.com advertising video samples & expansion of our business

- Video that bring 180+ sales through AD

- Shop416.com Intro video just launched

- Heart touching recitation with serenity

- How to Change Your Mindset - Change The Way You Think

- Canada pension plan and old age security

- How do you change your life using Self-Coaching?

- Dua for protection of children from evil eye

- If God dies in cross who is running the universe

- Truth about COVID vaccine

- Participate in

- Physically fit -a limitless creativity

- Sinicization & Zionism is the end goal of China Israel and West

- Palestinians are ready to die with smile while world is blind

- The topic Hypocrisy Hypocrites mentioned in Quran

- Death is a universal truth and every one of us has to taste it

- The bodies of 215 children were discovered in unmarked graves

- Message to all Humanity on Earth

- The secrets and great benefits of Magnesium

- If we burn, you burn with us message Zionist

- UN is launching an investigation into alleged war crime in Gaza

- Israel is exposed, world should know

- All protein actually came from plant

- power of social media

- Boycott products like boycott to stop Zionism, oppressions and racism

- Israeli government is number one child & organ trafficker

- Flakka a drug from evil society with a de-population game plan

- Feel likes the world goes blind

- Palestine become a salvation for Jews

- Oppressors and Hypocrites has two faces

- The rulers of darkness of this world are Hypocrites

- Zionism and Israelism can not succeed without American Zionists

- Boycott apartheid criminal regime of Israel

- I cannot sleep every night, I am so traumatized

- Software & Online Platform- Earn Money online

- Five Scientific Miracles of the Quran

- video in video AD

- Human cell made by Creator

- 25 product in Live Action video

- Husband is rude, abusive and bad tempered

- Why Islam is the fastest growing religion on earth

- Video rendering or editing With AI Technology

- Time travel

- Internet infected with COVID

- Survival the fittest

- I eat halal food and do harram things

- Islam is the best religion and Muslims are the worst followers

- Difference between Transparent, Translucent and Opaque

Social Media

Connect Us:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our TikTok channels:

shop416.com Channel

shop718.com Channel

bdcom.ca Channel

islam.LOL Channel

bangladesh2000.com Channel

Social media Group

CJ Drop-shipping APP

Our TikTok channels:

shop416.com Channel

shop718.com Channel

bdcom.ca Channel

islam.LOL Channel

bangladesh2000.com Channel

Social media Group

CJ Drop-shipping APP